Fiscal Expenditures. Incentives, deductions and exemptions: how many exist? Who benefits from them?

Together with the update memo to the DEF (Economic and Financial Document), in a few days the Government will be publishing its First Preliminary Report on Fiscal Expenditure: exemptions, deductions, tax credits, and favourable tax rates that the executive has been tasked with "reducing, eliminating or reforming", acting specifically on measures that are "unjustified" or "superceded".

For years now, the European Union Council has been asking Italy to reduce its "use and generosity of exemptions and preferential treatment". The National Reform Plan (PNR) has scheduled an overhaul for 2017 and 2018. Italy has hundreds of measures that are 'classified as tax expenditures, involving tens of millions of taxpayers. However, surveys carried out in recent years on the exact number of incentives to be overhauled, the amounts paid out to beneficiaries and the various consequences on income, have all painted a different picture.

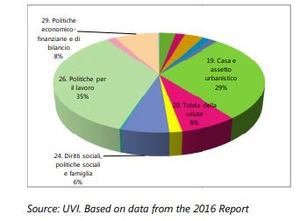

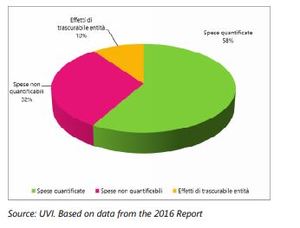

This research paper provides an update on what data and information is available and what is missing, starting from work carried out by the Committee that assists the Government in monitoring tax expenditure: in 2016, adding up State and local taxes, experts found a total of as many as 610 different measures, with a financial impact equal to -€76.5 billion, and yet no information is available on 67.5% of State tax expenditure.

Focus (in English)

Focus (in English)